Contents:

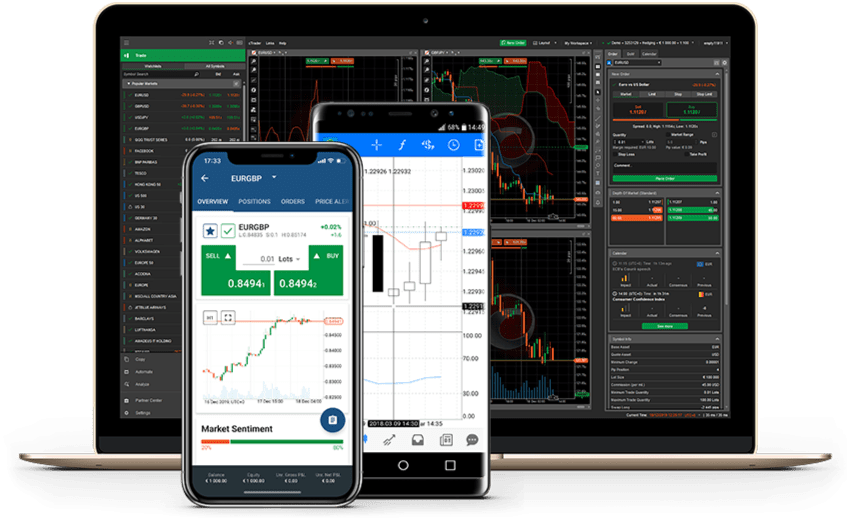

Workflow Products A suite of powerful, end-to-end workflow products to help navigate the markets. The content on this website is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. The STP is possibly the best choice, however a solid Market Maker could be a good idea for some investors.

These brokers make money by charging commissions or by profiting from spreads. All transactions in Forex are conducted between two foreign currencies, also known as fiat money. LSEG Labs created the FX Impact Intelligence app to help FX professionals stay on top of the important events impacting currency pairs throughout the day. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools.

Scalable & Flexible for company-wide impact

After the preprocessing stage, ME_TI_LSTM was trained using the macroeconomic and technical indicators mentioned above together with the closing values of the EUR/USD currency pair. LSTM is a recurrent neural network architecture that was designed to overcome the vanishing gradient problem found in conventional recurrent neural networks . Errors between layers tend to vanish or blow up, which causes oscillating weights or unacceptably long convergence times. The initial LSTM structure solves this problem by introducing the constant error carousel . In this way, the architecture ensures constant error flow between the self-connected units . Even though LSTM is starting to be used in financial markets, using it in Forex for direction forecasting between two currencies, as proposed in the present work, is a novel approach.

Besides, the enhanced forecasting capability of fusing multiple features including shallow and deep features is confirmed. We used a balanced data set with almost the same number of increases and decreases. Two baseline models were implemented, using only macroeconomic or technical indicator data. We observed that, compared to TI_LSTM, ME_LSTM had a slightly better performance in terms of both profit_accuracy and the number of transactions generated. Furthermore, combining all of the features into a single LSTM, called ME_TI_LSTM, did not significantly increase accuracy. Moreover, combining two data sets into one seemed to improve accuracy only slightly.

Proposed model: hybrid LSTM model

They inveshttps://forexarena.net/gated many different aspects of the stock market and found that LSTM was very successful for predicting future prices for that type of time-series data. They also compared LSTM with more traditional machine learning tools to show its superior performance. Nelson et al. examined LSTM for predicting 15-min trends in stock prices using technical indicators.

Dunis , https://trading-market.org/ Financial Markets, John Wiley & Sons, Chichester. Feeny [eds.], Exchange Rate Forecasting, Probus Publishing Company, Cambridge, UK. Scholes , ‘The pricing of Options and Corporate Liabilities’, Journal of Political Economy, 81, 637–659. Bollerslev , ‘Mra-Day and Inter-Market Volatility in Exchange Rates’, Review of Economic Studies, 58, 565–585. Predicts future movements in the value of the Canadian dollar versus the Japanese yen using Time Series Modelling and Regression Analysis. Semantic Scholar is a free, AI-powered research tool for scientific literature, based at the Allen Institute for AI.

Model Selection

Below, we report one-https://forexaggregator.com/-, three-days-, and five-days-ahead prediction results for our hybrid model based on the extended data. Qiu and Song developed a genetic algorithm —based optimized ANN to predict the direction of the next day’s price in the stock market index. Two types of input sets were generated using several technical indicators of the daily price of the Nikkei 225 index and fed into the model. They obtained accuracies 60.87% for the first set and 81.27% for the second set. The foreign exchange market, known as Forex or FX, is a financial market where currencies are bought and sold simultaneously.

- The aim of this review is first to present the core architecture of a HMM-based LVCSR system and then to describe the various refinements which are needed to achieve state-of-the-art performance.

- It’s a matter of time—one is either losing or winning at any particular moment.

- The Adaboost model learns sequentially at each stage by identifying points with higher weights that were misclassified in the previous stage.

- Feeny [eds.], Exchange Rate Forecasting, Probus Publishing Company, Cambridge, UK.

- Instead, we propose a rule-based decision mechanism that acts as a kind of postprocessing; it is used to combine the results of the baselines into a final decision (Yıldırım and Toroslu 2019).

- The input layer of our model is the features we scraped and the output layer is the corresponding label, an increase or decrease in 20 pips.

The main risk of trading currencies is brokers who might not be regulated, which is rather rare nowadays, yet still a concern. Every broker must undergo procedures and meet financial regulations that impose obligations, limits, and recommendations on financial firms. Making smart trading decisions means staying on top of relevant market events in real time and evaluating their impact on global currencies.

Ghazali et al. also investigated the use of neural networks for Forex. They proposed a higher-order neural network called a dynamic ridge polynomial neural network . In their experiments, DRPNN performed better than a ridge polynomial neural network and a pi-sigma neural network . Both macroeconomic and technical indicators are used as features to make predictions. A popular deep learning tool called LSTM, which is frequently used to forecast values in time-series data, is adopted to predict direction in Forex data.

JP Morgan says EUR/USD fair value (short term models) ranges between 1.07-1.09 – ForexLive

JP Morgan says EUR/USD fair value (short term models) ranges between 1.07-1.09.

Posted: Tue, 28 Feb 2023 22:54:00 GMT [source]

MACD uses the short-term moving average to identify price changes quickly and the long-term moving average to emphasize trends (Ozorhan et al. 2017). Moving average is a trend-following indicator that smooths prices by averaging them in a specified period. MA can not only identify the trend direction but also determine potential support and resistance levels . LSTM offers an effective and scalable model for learning problems that includes sequential data (Greff et al. 2017).

Ballings et al. evaluated ensemble methods against neural networks, logistic regression, SVM, and k-nearest neighbor for predicting 1 year ahead. According to the median area under curve scores, random forest showed the best performance, followed by SVM, random forest, and kernel factory. Guresen et al. explored several ANN models for predicting stock market indexes. These models include multilayer perceptron , dynamic artificial neural network , and hybrid neural networks with generalized autoregressive conditional heteroscedasticity . Applying mean-square error and mean absolute deviation , their results showed that MLP performed slightly better than DAN2 and GARCH-MLP while GARCH-DAN2 had the worst results.

How AI is Revolutionizing Forex Trading – Scottish Business News

How AI is Revolutionizing Forex Trading.

Posted: Thu, 23 Feb 2023 08:00:00 GMT [source]

A B-Book model provides constant spreads regardless of whether you trade during busy market hours or off-market hours, which is yet another solid reason to use a B-Book broker. When using the B-Book Forex model, you usually pay a predetermined spread each time you initiate or exit a transaction. An A-Book broker works as a bridge that links a trader’s terminals to a liquidity provider, or LP. Thus, the A-Book approach implies that orders are sent directly to the interbank market, where these orders are filled by liquidity providers. A news impact monitor uses event clustering and filtering models to create a curated feed of events related to currency markets. With so many unprofitable traders, a B-Book model provides an additional source of revenue.

The broker does not use an external liquidity pool to carry out deals; instead, the business serves as a counterparty to the trader’s transactions. A foreign exchange broker is a firm whose purpose is to connect traders and investors to a specialized platform where foreign currency can be bought and sold. We will discuss pricing and order execution quality in more detail in later lessons, but first, let’s learn one more “risk management” approach that forex brokers use. While your forex broker is always the counterparty to your trades, a hybrid approach is where the broker may decide to execute your trades internally OR offset your trades externally to a liquidity provider. An earlier pricing model was published by Biger and Hull, Financial Management, spring 1983.

- We used individual LSTM models and the simple combined LSTM as baselines and compared them with our proposed hybrid model.

- Thus, based on the obtained system model, the hierarchical sliding-mode control can be directly applied in the trajectory tracking control of the X-Z inverted pendulum.

- The idea of Algorithm 1 is to determine the upper bound of the threshold based on 85% coverage of all differences.

- There is nothing wrong with a retail broker having a hybrid of both A-Book and B-Book.

- The exchange rate change corresponds to an appreciation of the U.S. dollar and a depreciation of the British pound.

When not all of the positions are able to be hedged, the excess market risk exposure is then hedged externally. For STP brokers, much also depends on the type of liquidity provider they use. If the cash flow is uncertain, a forward FX contract exposes the firm to FX risk in the opposite direction, in the case that the expected USD cash is not received, typically making an option a better choice. Multiverse specializes in quantum computing-based solutions for financial services and works with Bank of Canada, CaixaBank, BBVA and Credit Agricole, among others. Its Singularity toolkit provides quantum and quantum-inspired algorithms for financial institutions. BASF and Multiverse Computing are partnering to develop forex optimization quantum computing models.